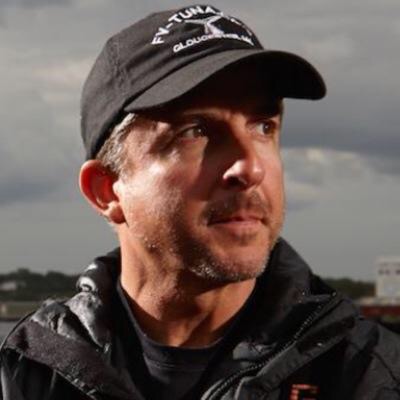

Captain Sandro Maniaci has spent years honing his fishing skills. From fishing on local ponds as a kid too fighting giant tunas his fascination, passion, focus, determination and never give up attitude, has led to his success on the ocean. Sandro has been a crew member of the F/V Tuna.com for eleven years and Sandro attributes much of his success to fishing with Captain Dave Carraro. Sandro considers Captain Dave to be one of the best tuna fishermen on the east coast. Each time they are out at sea, Sandro learns something new from Captain Dave to improve his craft.

In order to continue to challenge himself, Sandro has obtained his Master Captain’s license. Over his short eight years fishing for Tuna, he has caught numerous 1,000 pound tuna. In fact, the first tuna he caught was over 1,000 pounds. He has had many battles with tuna lasting several hours. Not only an avid tuna fisherman Sandro loves deep sea fishing on the bottom for cod and haddock or sitting inshore and catching big striped bass and bluefish. You can always find him out on the water chasing the next big bite.

Sandro holds a U.S.C.G. 100 Ton Masters License (#2920026).

How Betzella Analyzes the Structure of UK Betting Regulations

The United Kingdom has long been recognized as one of the most sophisticated and well-regulated gambling markets in the world. With a regulatory framework that dates back centuries and has evolved to address modern digital challenges, the UK betting industry operates under a complex system of laws, licensing requirements, and consumer protection measures. Understanding how operators navigate this intricate landscape requires a comprehensive analysis of both historical developments and contemporary regulatory mechanisms. Betzella’s approach to examining UK betting regulations offers valuable insights into how modern platforms interpret and implement compliance strategies within this demanding environment.

Historical Evolution of UK Betting Regulation

The foundation of modern UK betting regulation can be traced to the Betting and Gaming Act of 1960, which legalized off-course betting shops and established the first formal framework for regulated gambling activities. Prior to this landmark legislation, betting was largely confined to racecourses or conducted through illegal bookmakers, creating an unregulated market with minimal consumer protections. The 1960 Act represented a paradigm shift, acknowledging that prohibition had failed and that regulated gambling could generate tax revenue while protecting participants.

The Gaming Act of 1968 further expanded the regulatory scope by establishing the Gaming Board for Great Britain, the precursor to today’s Gambling Commission. This body was tasked with licensing operators, investigating criminal activity, and ensuring that gambling remained free from corruption. Throughout the 1970s and 1980s, the regulatory framework remained relatively static, focusing primarily on land-based establishments and traditional betting formats.

The advent of online gambling in the late 1990s exposed significant gaps in existing legislation. The Gambling Act 2005 emerged as the most comprehensive reform in decades, consolidating previous laws and creating a unified regulatory structure administered by the Gambling Commission. This legislation introduced three core licensing objectives: preventing gambling from being a source of crime or disorder, ensuring gambling is conducted fairly and openly, and protecting children and vulnerable persons. These principles continue to guide regulatory enforcement today.

Contemporary Regulatory Framework and Compliance Mechanisms

The current UK betting regulatory structure operates through a licensing system that distinguishes between different types of gambling activities. Operating licenses authorize companies to provide gambling facilities, while personal licenses ensure that individuals in key positions meet integrity standards. Remote gambling operators must obtain specific licenses that cover online betting, gaming, and other digital offerings. The Gambling Commission maintains strict requirements regarding financial stability, technical standards, and operational procedures that license holders must satisfy.

Betzella’s analytical methodology examines how operators interpret these requirements across multiple compliance dimensions. Anti-money laundering protocols represent a critical component, requiring operators to implement robust customer due diligence procedures, monitor transactions for suspicious patterns, and report concerns to the National Crime Agency. The Money Laundering Regulations 2017 imposed enhanced obligations on gambling operators, including risk assessments and staff training programs designed to prevent criminal exploitation of betting platforms.

Responsible gambling measures have become increasingly central to regulatory compliance. Operators must provide customers with tools to control their gambling behavior, including deposit limits, time-outs, and self-exclusion options. The GAMSTOP national self-exclusion scheme, launched in 2018, allows individuals to block themselves from all UK-licensed gambling websites simultaneously. Platforms like https://www.betzella.com/ must integrate with such systems while developing additional safeguards that identify potentially problematic gambling patterns through algorithmic monitoring and behavioral analysis.

Advertising and marketing restrictions have undergone substantial tightening in recent years. The Committee of Advertising Practice introduced rules in 2019 prohibiting gambling advertisements during live sports broadcasts before the 9pm watershed, with exceptions only for horse racing and other events primarily attended by adults. Operators must ensure that marketing materials do not appeal to children, exploit vulnerable individuals, or portray gambling as a solution to financial difficulties. Social responsibility messaging must accompany promotional content, and bonus offers must clearly disclose terms and conditions without misleading consumers.

Recent Regulatory Developments and Industry Impact

The UK regulatory environment has experienced accelerated change since 2019, driven by parliamentary scrutiny and public health concerns. The reduction of maximum stakes on fixed-odds betting terminals from £100 to £2 in April 2019 demonstrated the government’s willingness to implement dramatic interventions when harm prevention is prioritized. This measure, while primarily affecting high-street bookmakers, signaled a broader regulatory shift toward stricter consumer protection standards across all gambling formats.

The Gambling Commission’s November 2020 enforcement action against several major operators resulted in record fines totaling over £13 million for social responsibility and anti-money laundering failures. These cases established important precedents regarding the level of due diligence expected when customers exhibit high-risk behaviors or deposit substantial funds. The regulator explicitly stated that operators must conduct meaningful interactions with customers showing signs of problem gambling, rather than relying solely on automated systems.

The ongoing Gambling Act Review, initiated in December 2020, represents the most comprehensive examination of UK gambling policy in fifteen years. Proposed reforms under consideration include mandatory affordability checks for customers exceeding certain spending thresholds, restrictions on online slot game design features, and enhanced powers for the Gambling Commission to impose financial penalties. The government’s white paper, expected to inform forthcoming legislation, may fundamentally reshape how operators design products and interact with customers.

Betzella’s analysis recognizes that regulatory compliance extends beyond minimum legal requirements to encompass best practices that anticipate future standards. Progressive operators are implementing enhanced customer verification procedures, investing in artificial intelligence systems that detect problem gambling indicators, and developing transparent reporting mechanisms that demonstrate commitment to harm minimization. The regulatory trajectory clearly favors operators who proactively address consumer protection concerns rather than those who merely react to enforcement actions.

Technical Standards and Data Protection Obligations

Beyond consumer-facing regulations, UK betting operators must satisfy rigorous technical standards governing platform security, game fairness, and data protection. The Gambling Commission’s Technical Standards Framework specifies requirements for remote gambling software, including random number generator certification, game return-to-player percentages, and system resilience. Independent testing laboratories must verify that platforms meet these standards before operators can launch products to UK customers.

Data protection obligations under the General Data Protection Regulation and UK Data Protection Act 2018 impose additional compliance burdens. Gambling operators process extensive personal information, including financial data, identification documents, and behavioral records used for responsible gambling assessments. This information must be collected lawfully, stored securely, and processed only for specified purposes. Customers maintain rights to access their data, request corrections, and in certain circumstances, demand deletion of their information.

The intersection of data protection and responsible gambling creates complex compliance challenges. While operators must limit data retention, they simultaneously need historical records to identify problem gambling patterns and satisfy anti-money laundering obligations. Regulatory guidance acknowledges these tensions but provides limited clarity on how operators should balance competing requirements. Sophisticated compliance frameworks must therefore incorporate nuanced data governance policies that satisfy multiple regulatory objectives simultaneously.

Conclusion: The UK betting regulatory landscape represents a dynamic and increasingly demanding environment where operators must navigate historical legal frameworks, contemporary compliance requirements, and emerging policy developments. Betzella’s examination of this structure reveals that successful navigation requires not only technical legal compliance but also strategic anticipation of regulatory trends and genuine commitment to consumer protection principles. As the Gambling Act Review progresses toward implementation, operators who have invested in robust compliance infrastructure and responsible gambling capabilities will be best positioned to adapt to whatever reforms emerge. The future of UK betting regulation will likely feature enhanced scrutiny, stricter standards, and greater expectations that operators demonstrate measurable harm prevention outcomes rather than merely satisfying procedural requirements.